Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsGoalbased InvestingTheory and Practice eBook Romain Deguest, Lionel Martellini, Vincent Milhau Amazonca BooksVincent Milhau and published by WSPC The Digital and eTextbook ISBNs for Goalbased Investing are , and the print ISBNs are , Save up to 80% versus print by going digital with VitalSource

Goal Based Investing Theory And Practice By Romain Deguest Ebay

Goal-based investing theory and practice

Goal-based investing theory and practice-31/7/21 Goalbased Investing Theory And Practice by Romain Deguest, , available at Book Depository with free delivery worldwideDownload full Goal Based Investing Theory And Practice Books, available in PDF, EPUB, textbook and kindle format for free or Read online Goal Based Investing Th

Almost Everything You Know About Impact Investing Is Wrong

16/4/17 What Is GoalsBased Investing?17/8/ Goalsbased investment theory not only acknowledges these goals, it provides budgets and portfolios for them In the end, goalsbased investing is simply about using financial markets to achieve your goals under realworld constraints But that can only happen by first understanding and modeling the objectives you're actually trying to achieve13/7/21 Pris 1624 kr ebok, 21 Laddas ned direkt Köp boken Goalbased Investing Theory And Practice av Deguest Romain Deguest, Martellini Lionel Martellini, Milhau Vincent Milhau (ISBN ) hos Adlibris Alltid bra priser och snabb leverans Adlibris

27/7/21 Goalbased Investing Theory And Practice 324 by Romain Deguest, Lionel Martellini, Vincent Milhau Hardcover $ 7800 Hardcover $7800 NOOK Book $2349 View All Available Formats & Editions Ship This Item — Qualifies for Free Shipping Buy Online, Pick up in13/7/21 Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedgingGoalbased Investing Theory and Practice Romain Deguest, Lionel Martellini, Vincent Milhau Amazoncomau Books

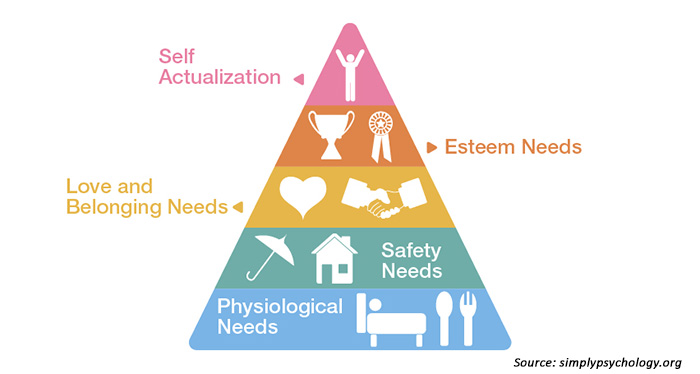

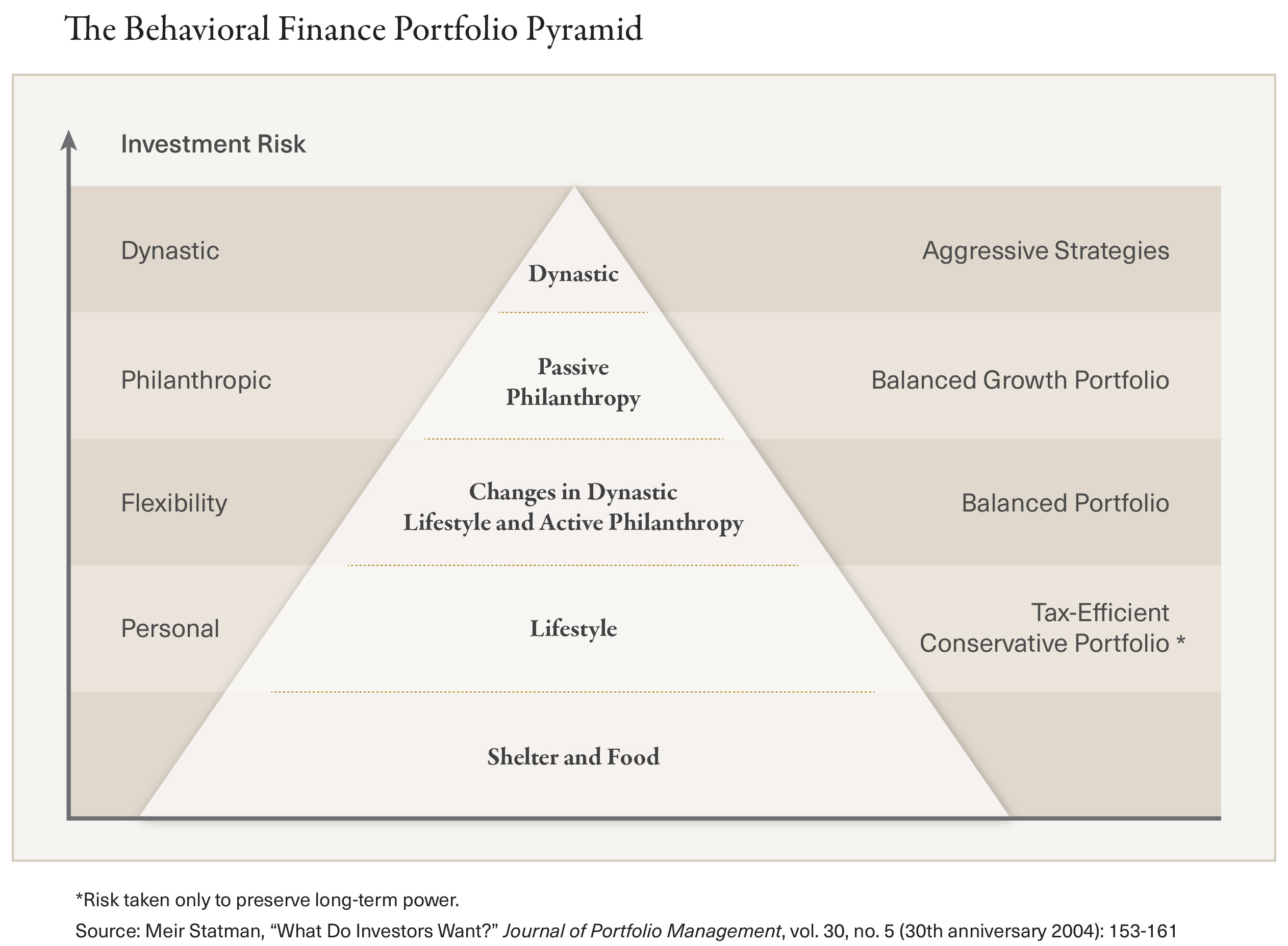

GoalsBased Investing or GoalDriven Investing (sometimes abbreviated GBI) is the use of financial markets to fund goals within a specified period of timeTraditional portfolio construction balances expected portfolio variance with return and uses a risk aversion metric to select the optimal mix of investments By contrast, GBI optimizes an investment mix to minimize theGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assets

Why Practicing Goal Based Investing Is Essential For Small Investors

Goal Based Investing The Planning Process In Practice Investorpolis

Goalbased Investing Theory And Practice eBook Romain Deguest, Lionel Martellini, Vincent Milhau Amazonin Kindle Store27/7/21 Get FREE shipping on Goalbased Investing Theory And Practice by Romain Deguest, from worderycom Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational frameworkSelecciona Tus Preferencias de Cookies Utilizamos cookies y herramientas similares que son necesarias para permitirte comprar, mejorar tus experiencias de compra y proporcionar nuestros servicios, según se detalla en nuestro Aviso de cookiesTambién utilizamos estas cookies para entender cómo utilizan los clientes nuestros servicios (por ejemplo, mediante la medición de las

Goals Based Investing Suggested As Replacement To Advisers Traditional Approach Ardent Wealth

Goal Based Investing Theory And Practice Ebook By Romain Deguest Rakuten Kobo United States

Buy Goalbased Investing Theory And Practice by Romain Deguest, Lionel Martellini, Vincent Milhau online at Alibris We have new and used copies available, in 1 editionsGoalbased Investing Theory And Practice Ebook written by Romain Deguest, Lionel Martellini, Vincent Milhau Read this book using Google Play Books app on your PC, android, iOS devices Download for offline reading, highlight, bookmark or take notes while you read Goalbased Investing Theory And PracticeGoalbased investing (GBI) implements dedicated investment solutions to generate the highest possible probability of achieving investors' goals, Goalbased investing Theory and practice Advances in Retirement Investing Construction Rules of Retirement Goal Price Indices

Back To The Future The Return Of Objective Based Investing Capital Group

Almost Everything You Know About Impact Investing Is Wrong

Goalbased Investing Theory and Practice is written by Romain Deguest;There is the need to design an investment solution that is a function of different kinds of risks to which individuals are exposed, or needs to could be exposed to fulfil their goals, as opposed to purely focusing on the risks impacting the market as a whole13/7/21 Synopsis Goal based Investing Theory And Practice written by Romain Deguest, published by World Scientific which was released on 13 July 21 Download Goal based Investing Theory And Practice Books now!Available in PDF, EPUB, Mobi Format Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth

Why You Should Be A Goals Based Investor Cfa Institute Enterprising Investor

Goals Based Investing A Visionary Framework For Wealth Management Davidow Tony Books Amazon Com

Goalbased Investing Theory and Practice Goalbased Investing Theory and Practice Romain Deguest, Lionel Martellini & Vincent Milhau Hardback / bound Engels Be the first to rate this book Available, delivery time 46 weeks Niet op voorraad in onze winkel €73Goalbased Investing in Practice The key challenge for goalbased investing (GBI) is to implement dedicated investment solutions aiming to generate the highest possible probability of achieving investors' goals, and a reasonably low expected shortfall in case adverse market conditions make it unfeasible to achieve those goalsGoalbased Investing There is the need to design an investment solution that is a function of different kinds of risks to which individuals are exposed, or needs to could be exposed to fulfil their goals, as opposed to purely focusing on the risks impacting the market as a wholeGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the

Real Success With Goals Based Investing Proactive Advisor Magazine

3

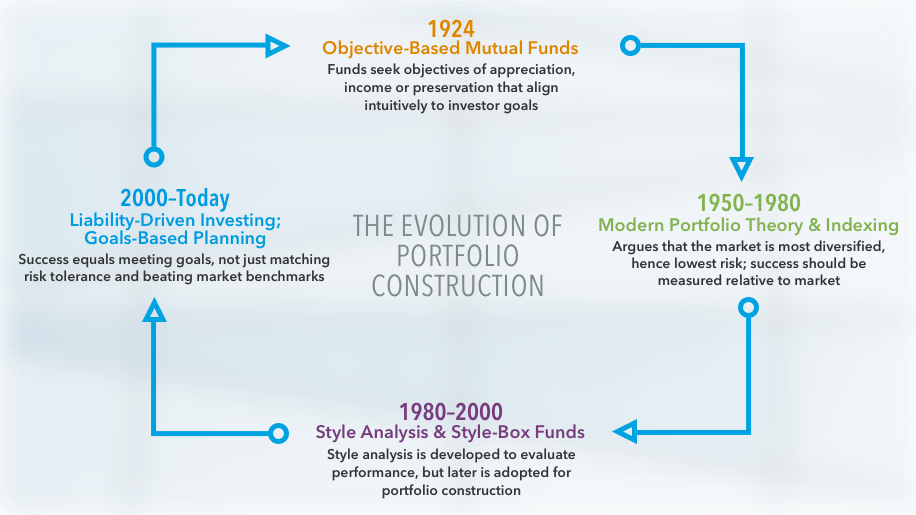

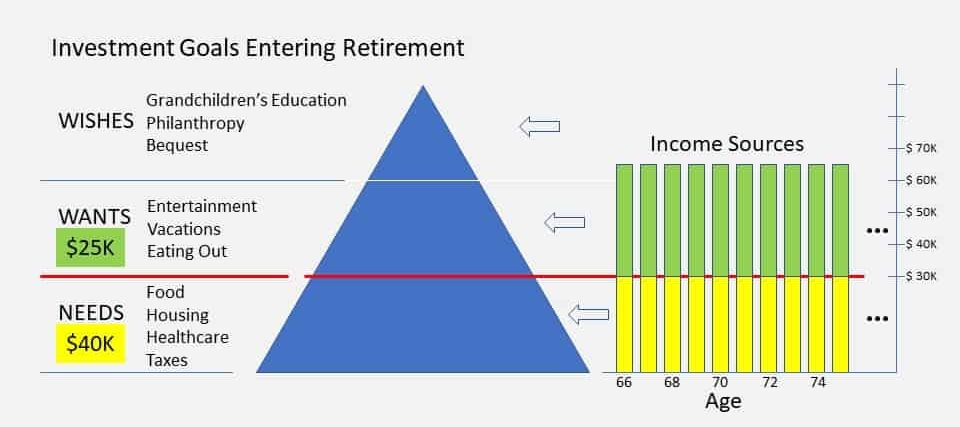

In the world of financial advice, we are seeing a welcome trend toward goalsbased investingThis trend puts a greater focus on the goals that investors want to achieve with their savings —such as retirement security, paying for college or purchasing a house — and uses these goals to drive investment strategy and monitor progress28/8/19 GoalsBased Investing Should It Be the Norm?31/7/21 Goalbased Investing Theory And Practice por Romain Deguest, , disponible en Book Depository con envío gratis

Amazon Com Goals Based Investing A Visionary Framework For Wealth Management Davidow Tony Books

The Power Of Goal Based Investing First Republic Bank

Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsRequest PDF On , Romain Deguest and others published Goalbased Investing Theory and Practice Find, read and cite all the research you need on ResearchGate13/7/21 Goalbased Investing Theory And Practice Romain Deguest, Lionel Martellini, Vincent MilhauEgrāmata Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and

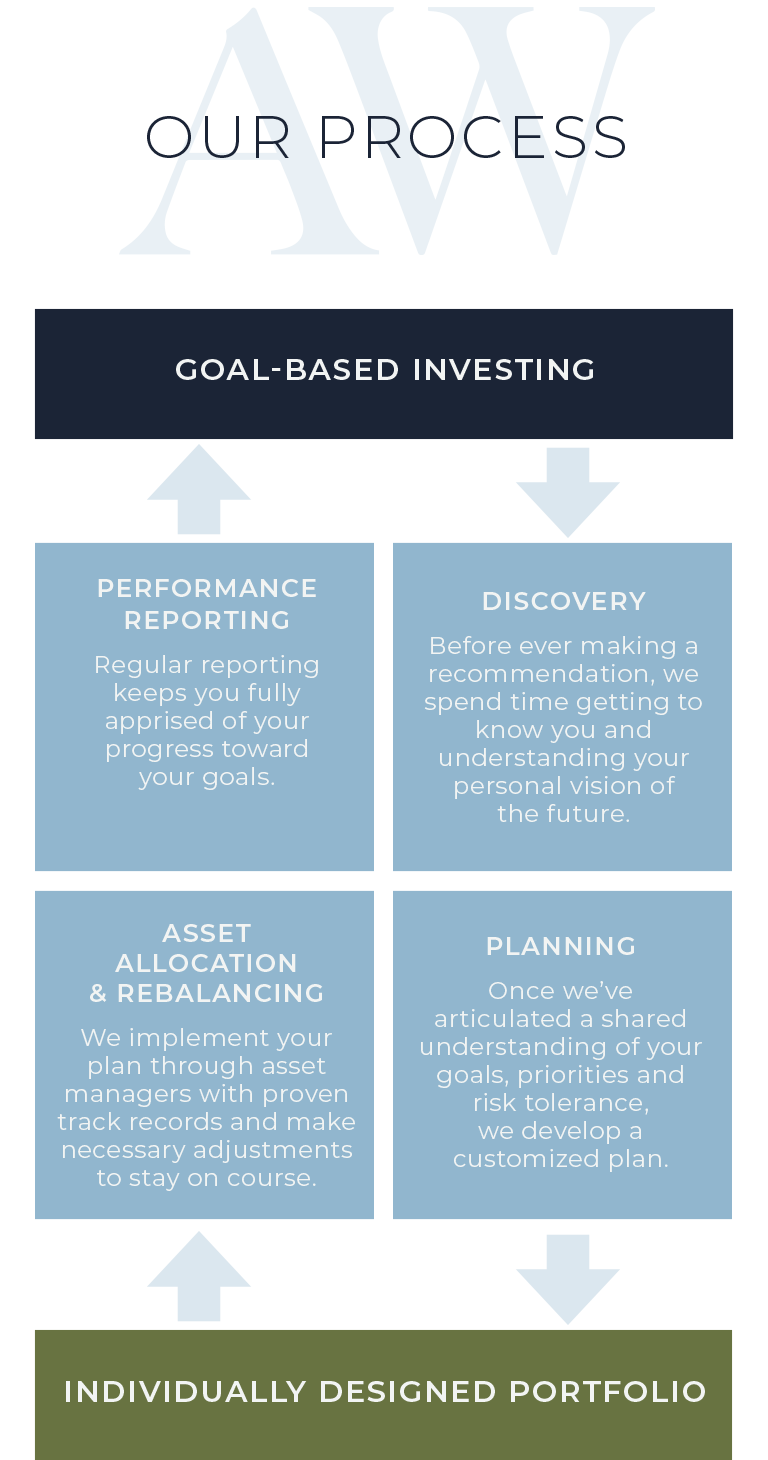

Goal Based Investing Alpha Wealth Advisors Llc

Pdf A Behavioral Perspective On Goal Based Investing

10/4/17 Goalsbased investing may seem like an obvious concept, but it represents a departure from the typical risktolerance framework, which profiles clients based on whether they have a conservativeGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsGoalsbased portfolio to a portfolio on the mean– variance Efficient Frontier This mathematical reconcilement showed that GBWM is supported by MVT, which also forms part of the basis for the model described in this paper There is a growing practitioner literature on goalsbased wealth management Nevins (04) extended the mental

Goal Based Investing Is The Modern And Correct Way To Personal Wealth Management And Investing Investorpolis

Goals Based Investing Should It Be The Norm Cfa Institute Enterprising Investor

1/7/21 Goalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedgingIn the world of financial advice, we are seeing a welcome trend toward goalsbased investing This trend puts a greater focus on the goals that investors want to achieve with their savings —such as retirement security,GoalsBased Investing From Theory to Practice 4 years ago by Loknath Das What Is GoalsBased Investing?

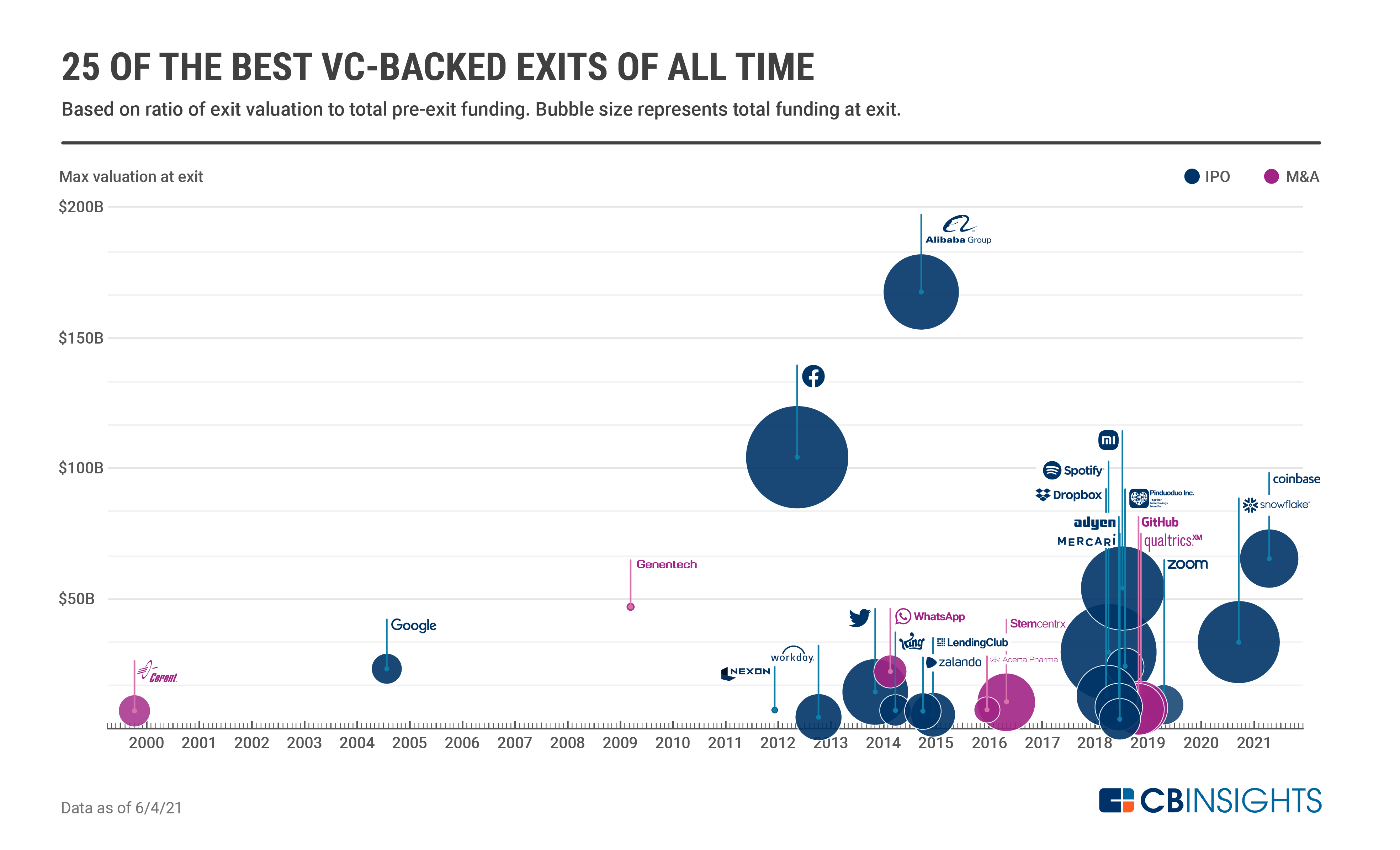

The 45 Best Vc Investments Of All Time What To Learn From Them Cb Insights Research

What Is Critical Race Theory And Why Is It Under Attack

Goalbased Investing Theory and Practice Romain Deguest, Lionel Martellini, Vincent Milhau Amazones Libros Selecciona Tus Preferencias de Cookies Utilizamos cookies y herramientas similares que son necesarias para permitirte realizar compras, mejorar tu experiencia de compra y prestar nuestros servicios, como se detalla en nuestro Aviso de cookiesGoalbased Investing Theory And Practice Deguest, Romain, Martellini, Lionel, Milhau, Vincent Amazonsg BooksTo paraphrase Richard Thaler, all finance is behavioral In the same spirit, all investment management should be goalsbased After all, both institutional and private investors hold assets to meet their liabilities and achieve their financial objectives

3

Goal Based Investing Wikipedia

Amazoncom GoalBased Investing Theory and Practice () Deguest, Romain, Martellini, Lionel, Milhau, Vincent BooksGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assetsGoalBased Investing Theory and Practice Deguest, Romain, Martellini, Lionel, Milhau, Vincent Amazoncommx Libros

Goals Based Investing From Theory To Practice

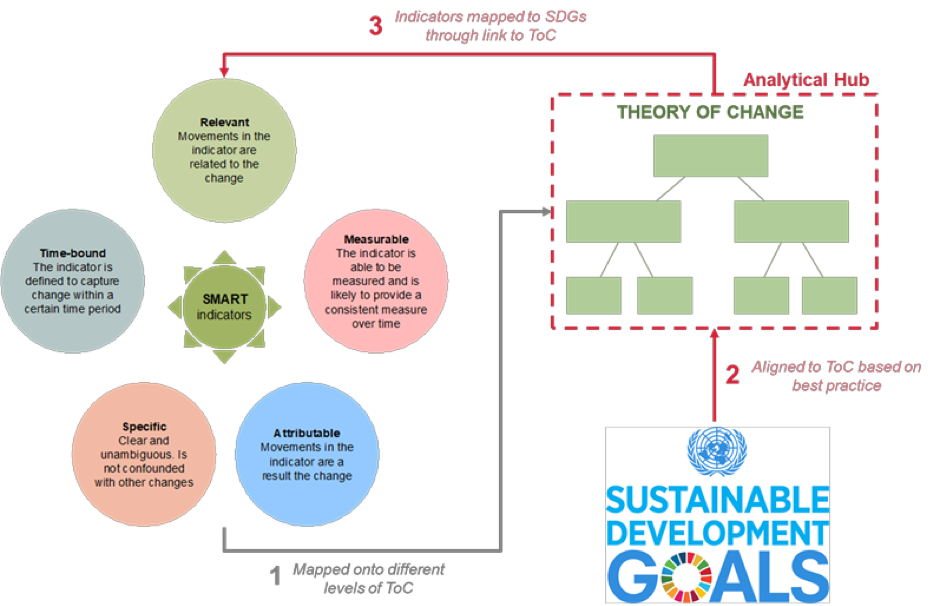

Monitoring And Evaluation For Impact Investing Better Evaluation

Amazonin Buy Goalbased Investing Theory And Practice book online at best prices in India on Amazonin Read Goalbased Investing Theory And Practice book reviews & author details and more at Amazonin Free delivery on qualified ordersGoalbased InvestingTheory and Practice eBook Romain Deguest, Lionel Martellini, Vincent Milhau Amazoncomau BooksGoalbased Investing Theory and Practice for Compare prices of products in Books from 513 Online Stores in Australia Save with MyShoppingcomau!

Institutionalisation And Deinstitutionalisation Of Children 2 Policy And Practice Recommendations For Global National And Local Actors The Lancet Child Adolescent Health

Goal Based Investing Theory And Practice By Romain Deguest Ebay

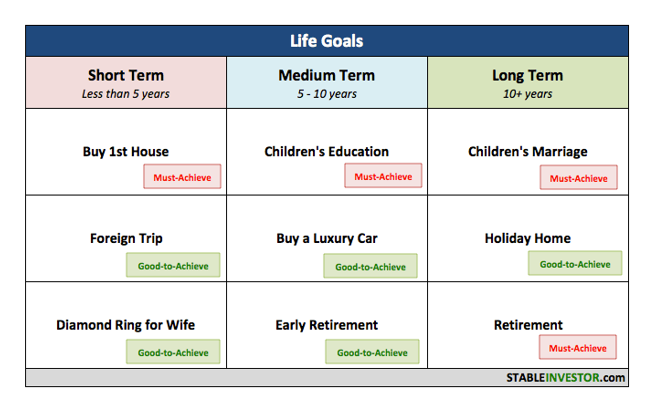

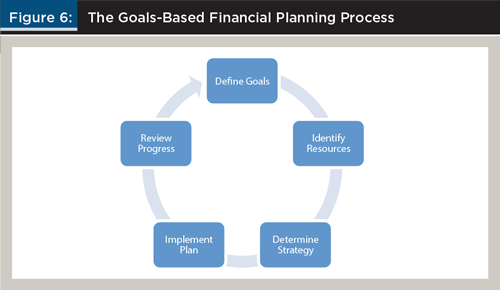

4 GoalBased Investing Theory and Practice Huang (19) to the presence of nonportfolio income It is wellknown that the existence of a stateprice deflator, or equivalently of anequivalent martingale measure,isnotsufficienttoavoid arbitrage opportunitiesGoalbased investing is a new paradigm that is expected to have a profound and longlasting impact on the wealth management industry This book presents the concept in detail and introduces a general operational framework that can be used by financial advisors to help individual investors optimally allocate their wealth by identifying performanceseeking assets and hedging assets5/1/ The goalbased investing planning process comprises 5 phases #1 Define possible financial objectives #2 Identify current and future available resources #3 Determine the appropriate strategy for the distribution of capital between savings and investments, in accordance with their characteristics and personal conditions, and aimed at achieving objectives #4 Implement the plan

Goals Based Investing From Theory To Practice

2

.png)

Vizibl How To Set Smart Goals With Suppliers

1

Vizibl How To Set Smart Goals With Suppliers

Goal Based Investing Mutual Funds Research App

What Is Goal Based Financial Planning Anyway Stable Investor

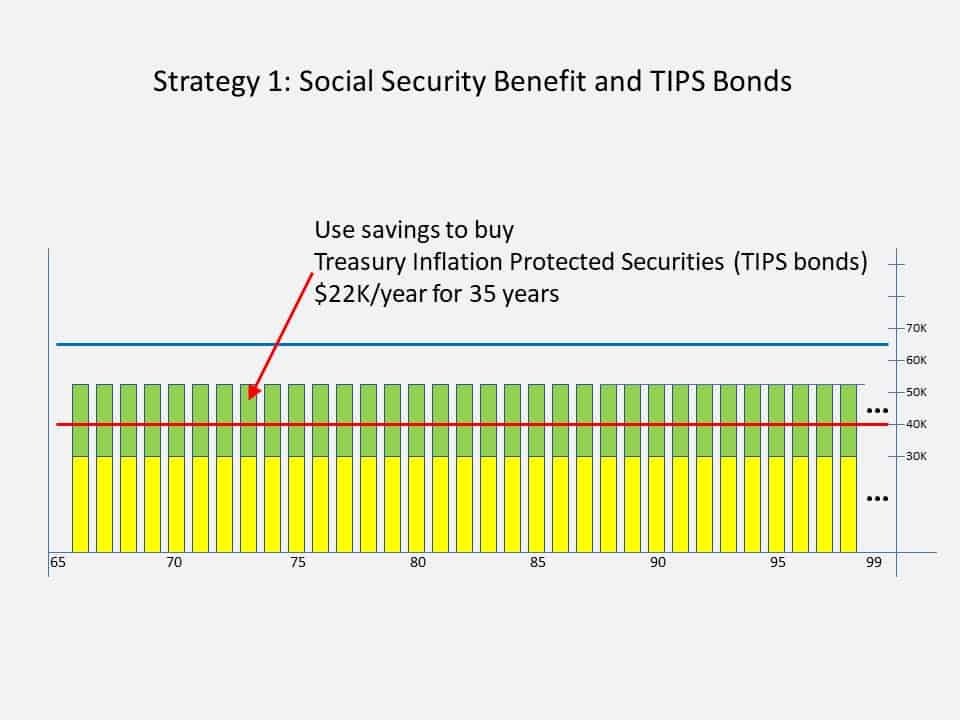

Goal Based Investment Planning Retirement Planning Example And Video

Goals Based Investing Or Modern Portfolio Theory Diligencevault

1

Learn More About Goal Based Investing Today Iinvest Solutions

Why Practicing Goal Based Investing Is Essential For Small Investors

2

2

Best Investment Apps Of 21 What Are The Best Investment Apps Now

Pdf A Single Case Experimental Design Investigation Of Collaborative Goal Setting Practices In Hospital Based Speech Language Pathologists When Provided Supports To Use Motivational Interviewing And Goal Attainment Scaling

/top-investing-strategies-2466844-FINAL-33a6c4fecfc14360837d5daa36c079a7.png)

Best Investment Strategies

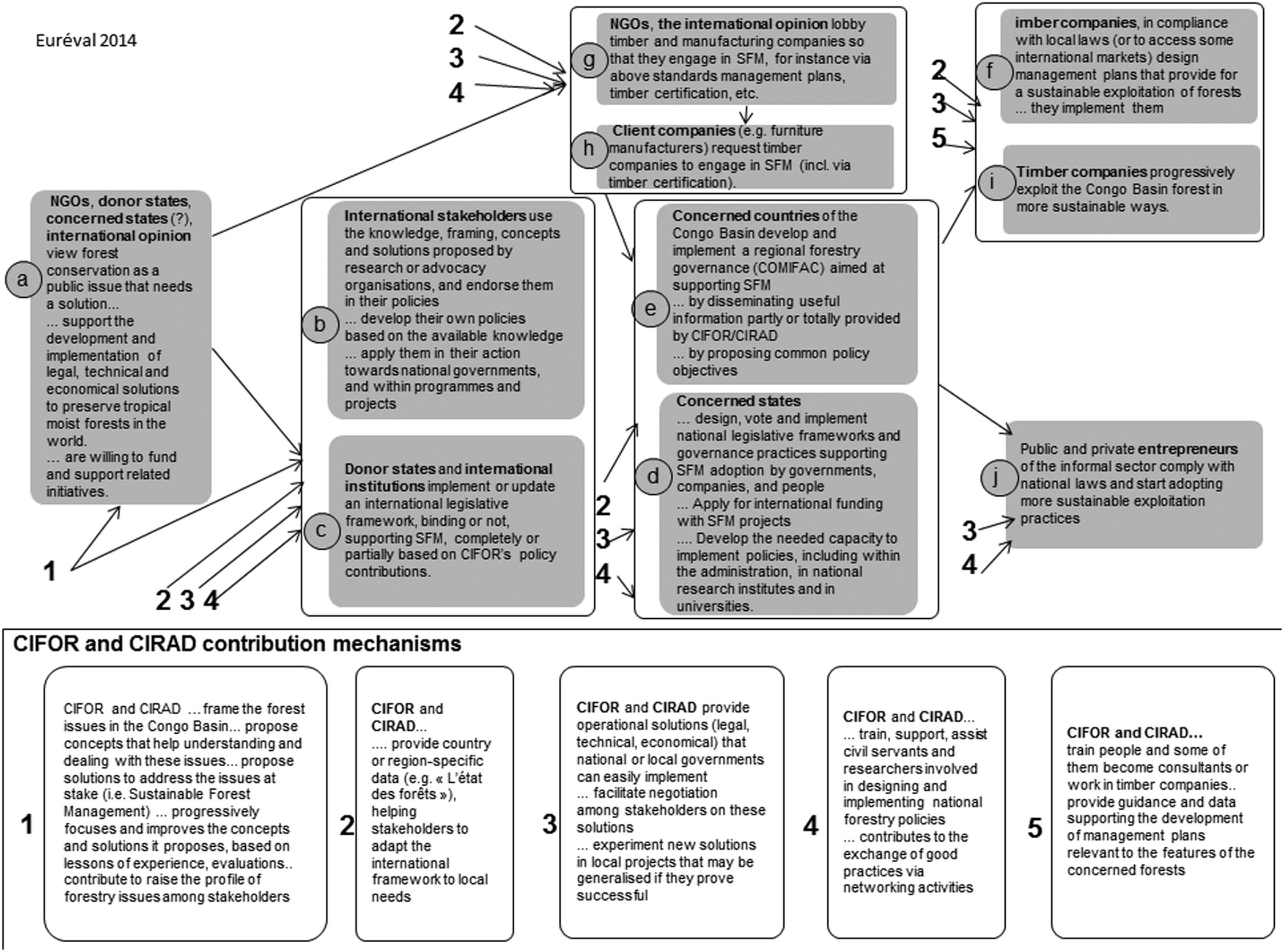

Evaluating Policy Relevant Research Lessons From A Series Of Theory Based Outcomes Assessments Humanities And Social Sciences Communications

Monitoring And Evaluation For Impact Investing Better Evaluation

Goal Based Investing Gbi Edhec Risk Institute

Retiresecure Blog Pension Research Council

Amazon Com Goal Based Investing Theory And Practice Romain Deguest Lionel Martellini Vincent Milhau Books

Implementation Plan For Low Carbon Resilient City Towards Sustainable Development Goals Challenges And Perspectives Aerosol And Air Quality Research

Life Cycle Investing From Target Date To Goal Based Investing The Journal Of Wealth Management

A Framework For Goals Based Investing Boston Private

Amazon Com Goals Based Investing A Visionary Framework For Wealth Management Davidow Tony Books

Land Free Full Text Inclusive Businesses And Land Reform Corporatization Or Transformation Html

How Top Personal Finance Companies Built The Best Pfm Apps

Wealth Management The Impact Of Goal Based Investing

High Quality Health Systems In The Sustainable Development Goals Era Time For A Revolution The Lancet Global Health

Investment And Portfolio Management Coursera

Goal Based Investing Ppt Powerpoint Presentation Outline Outfit Cpb Powerpoint Slide Presentation Sample Slide Ppt Template Presentation

Full Article Policy Failure And The Policy Implementation Gap Can Policy Support Programs Help

Goal Based Investing Gbi Edhec Risk Institute

Goals Based Investing An Approach That Puts Investors First

Life Cycle Investing From Target Date To Goal Based Investing The Journal Of Wealth Management

Goals Based Investing From Theory To Practice

Goals Based Investing An Approach That Puts Investors First

Three Pillars Of Goal Based Investing First Rate

Sim Tig Week Driving The Measurement Of Social Investment Towards 30 Integrating The Sdg S Into Impact Investment Monitoring Systems By Debby Nixon Williams Noel Verrinder And Kagiso Zwane Aea365

Goal Based Investing Theory And Practice Martellini Lionel Inbunden Adlibris Bokhandel

A Framework For Goals Based Investing Boston Private

/dotdash_Final_Risk_Feb_2020-01-66f3c5ffb3c040848f1708091fa40eb9.jpg)

Risk Definition

Back Button

Goal Based Investment Planning Retirement Planning Example And Video

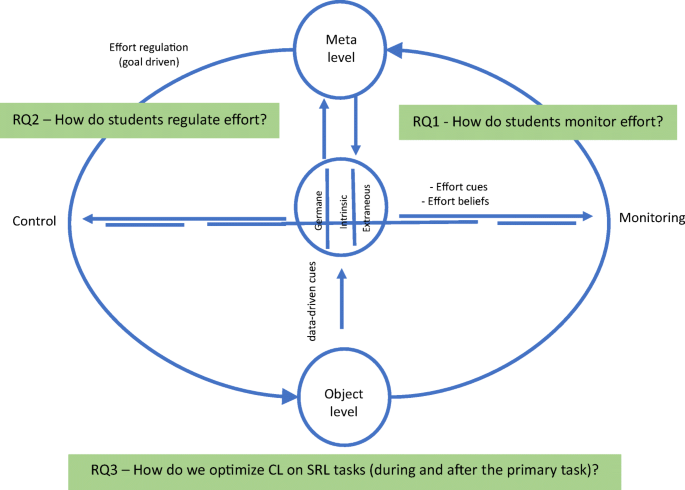

Synthesizing Cognitive Load And Self Regulation Theory A Theoretical Framework And Research Agenda Springerlink

Investment Management Integrated Wealth Management Financial Planner Investment Management Seattle

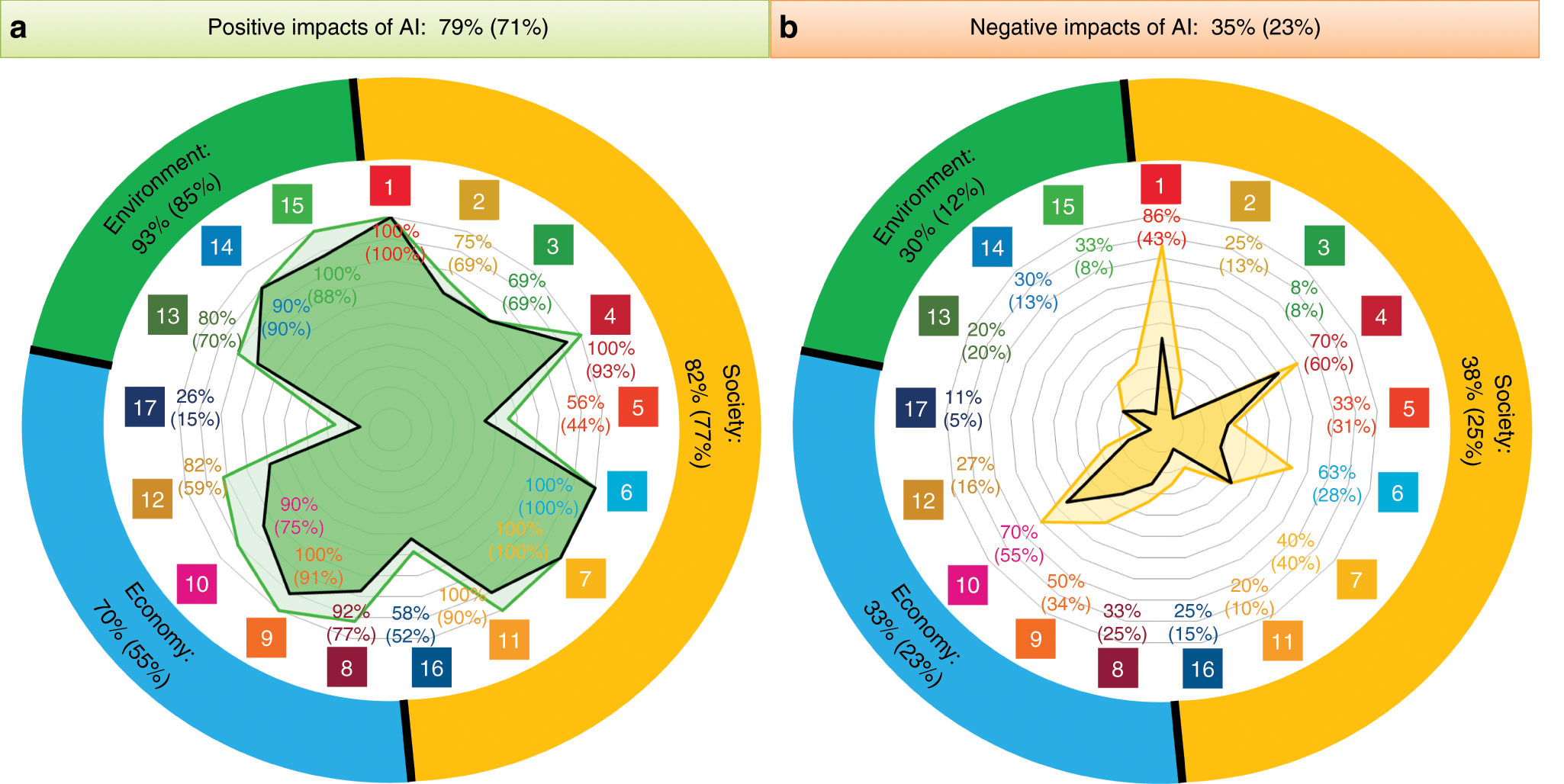

The Role Of Artificial Intelligence In Achieving The Sustainable Development Goals Nature Communications

/DeterminingRiskandtheRiskPyramid3-1cc4e411548c431aa97ac24bea046770.png)

Investment Pyramid

Has Financial Attitude Impacted The Trading Activity Of Retail Investors During The Covid 19 Pandemic Sciencedirect

Goal Based Investing Gbi Edhec Risk Institute

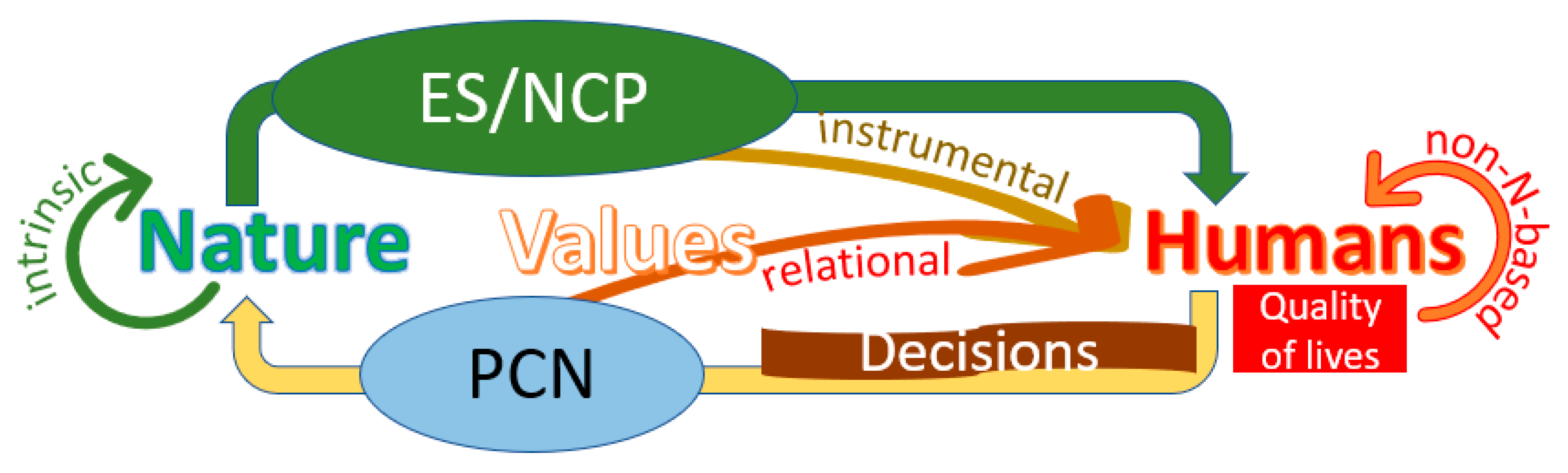

Land Free Full Text Agroforestry Based Ecosystem Services Reconciling Values Of Humans And Nature In Sustainable Development Html

:max_bytes(150000):strip_icc()/wealthfront-vs-td-ameritrade-essential-portfolios-072e85eb93f449cab08317a9625d8776.jpg)

Goal Based Investing Definition

Shareholders Are Getting Serious About Sustainability

Goals Based Investing Or Modern Portfolio Theory Diligencevault

Paul Schweigl Columbia University In The City Of New York United States Linkedin

I Have Heard Of Goal Based Investing What Now Arthgyaan

Learn More About Goal Based Investing Today Iinvest Solutions

Life Cycle Investing From Target Date To Goal Based Investing The Journal Of Wealth Management

World Scientific Publishing Book Depository

2

Goal Based Investing How Does It Work Everyfin Newsletter

2

What Is Goals Based Investing And How Does It Work Manulife Private Wealth

Full Article Sustainable Development Goals Sdgs And Pandemic Planning

Goal Based Investing Through Mutual Funds Youtube

You Can Be Rich With Goal Based Investing A Book By Subra Pattu

What Is Goal Based Financial Planning Peak Financial Services

Eton Advisors Wealth Management

Goal Based Investing Alpha Wealth Advisors Llc

Why Practicing Goal Based Investing Is Essential For Small Investors

Goals Based Investing From Theory To Practice

Why You Re Measuring Investment Risk And Success Wrong Investing 101 Us News

Goals Based Investing Or Modern Portfolio Theory Diligencevault

Goals Based Investing The Cnr Way A Fresh Take On An Established Approach

:max_bytes(150000):strip_icc()/ellevest-vs-betterment-ebf2bcde1eec4958969a2d2171f2687c.png)

Goal Based Investing Definition

Goal Based Investing The Planning Process In Practice Investorpolis

I Am Now Ready To Do Goal Based Investing What Now Arthgyaan

Higher Cost Of Finance Exacerbates A Climate Investment Trap In Developing Economies Nature Communications

Why Practicing Goal Based Investing Is Essential For Small Investors

0 件のコメント:

コメントを投稿